Online & Mobile Banking

EnrollOnline Banking Upgrade

We’re enhancing online and mobile banking with a new design. You’ll enjoy a clean, modern look, with new navigation designed to give you more control and easier access to our financial tools, making transactions faster and more efficient.

Bank Conveniently Wherever You Are

We make online banking simple, secure, and convenient. With customizable tools such as account alerts, budgeting features, and mobile check deposit, you can manage your finances anytime, anywhere. Biometric login and advanced encryption ensure your information stays safe while you enjoy a personalized banking experience designed around your needs.

Online Banking Tools

Mobile App

Click below to download our mobile banking app from the App Store or Google Play.

Bill Pay

Automate check and electronic payments to billers through Bill Pay. Set up recurring or one-time payments, view payment history, and receive due date reminders and notifications when payments are sent.

CardProtect

Control your debit card with the touch of a button. If you lose your debit card, turn your card off. When you find your debit card, simply turn it back on!

ClickSWITCH

Switching to Stockman Bank doesn't need to be a hassle. We've made it easier than ever with ClickSWITCH!

CreditStory

Get instant access to everything you need to know about your credit and see the impact of your financial decisions with the credit simulator.

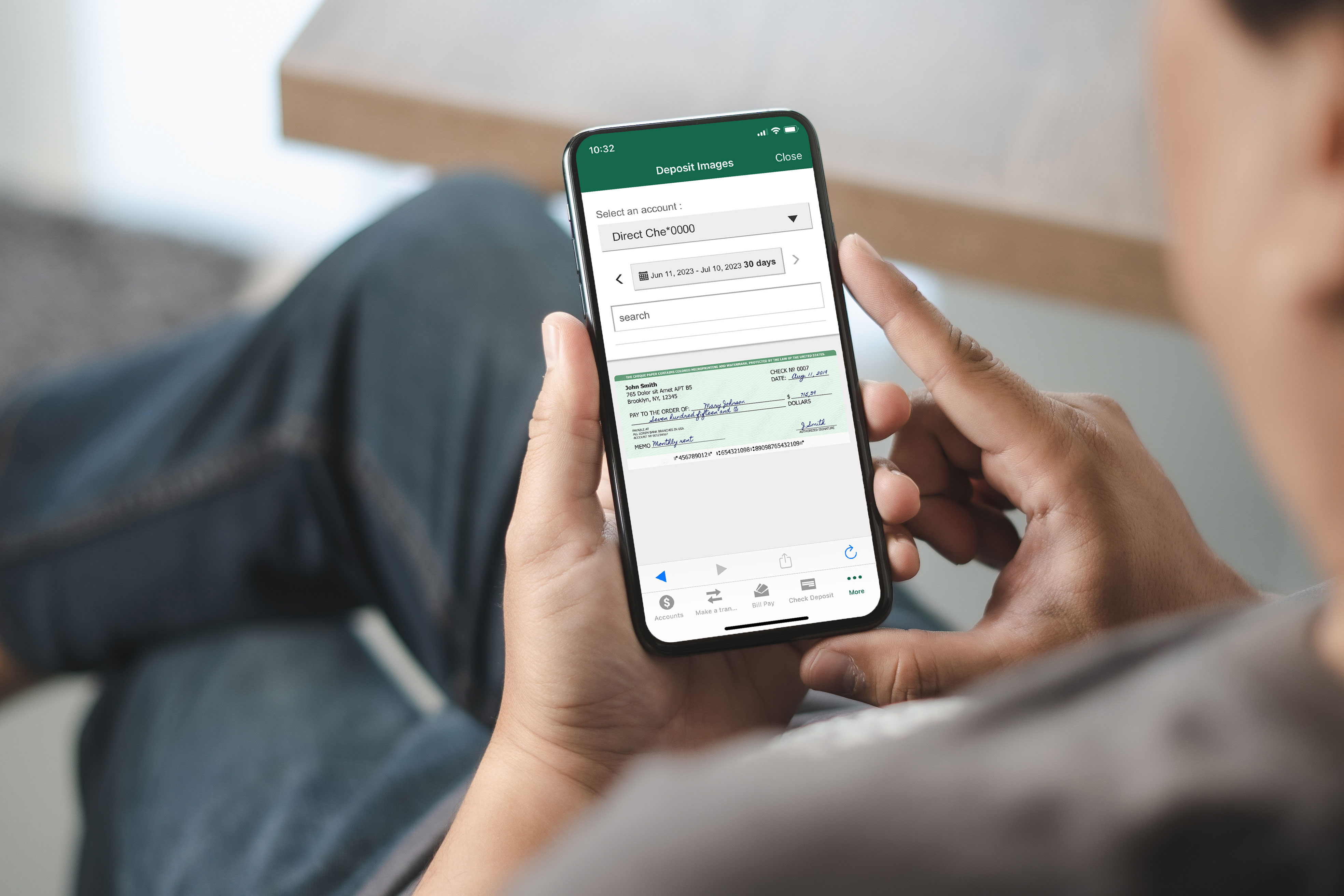

Mobile Check Deposit

Avoid trips to the bank with Mobile Check Deposit. Take photos of your check using our app, and deposit directly into your checking or savings account.

Money Management

Monitor all of your accounts in one place. Categorize transactions, set savings goals, and create and monitor budgets.

Online Statements

Online Statements are a free, safe and secure method to receive your statements. View, print and/or save for easy sharing with your accountant or for long-term storage, access up to 24 months of statement history from initial setup, and avoid mail fraud and mail theft.

Zelle®

Quickly and easily send money to friends and family with Zelle®. Available in our mobile app.

Digital Wallet Options

Additional Resources

Online Banking FAQs

Click here to enroll in Online Banking.

Our Central Customer Service hours are 7:00am - 6:00pm, Monday through Friday, and 9:00am - 1:00pm on Saturdays, excluding bank holidays. Give us a call at (877) 300-9369 during these hours to speak to one of our friendly representatives.

Customers enrolled in Online Banking can sign up to receive their statements online! Our Online Statements are a FREE, safe and secure method to receive your statements. View, print and/or save for easy sharing with your accountant or for long-term storage, access up to 24 months of statement history from initial setup, and avoid mail fraud and mail theft. From your mobile app, select More > Statements & Images > Online Statements at the top of your screen. Follow the prompts to switch!

Yes, you can set up alerts from your computer and tablet, and push notifications from your phone. Both alerts and notifications keep you up-to-date on your account activity.

To enroll in alerts from your desktop or tablet, log into your account and go to Access & Alerts > Text Banking and Alerts in the tool bar. Follow the prompts to set up your alerts.

To sign up for push notifications on your phone, log into your mobile app and click the Settings gear on the top right, then click Push Notifications.

Debit Cards

For lost or stolen Stockman Bank Visa Check Cards, call 1(866) 914-4595, or lock and unlock your personal debit card with CardProtect.

Credit Cards

For lost or stolen Stockman Business and Personal Mastercard Credit Cards, call 1(800) 367-7576, or lock and unlock your personal credit card with CardProtect.

CardProtect is an entire suite of tools that help keep your personal debit/credit card safe and secure! To find CardProtect within online banking, go to Financial Tools > CardProtect.

If you lose your personal debit/credit card, simply turn your card off. When you find your card, simply turn it back on!

Click here to learn more about CardProtect.

- You must be enrolled in online banking to utilize the Stockman Bank app.

- Launch the Stockman Bank app and log in with user credentials.

- Endorse the back of the check. You must write "For Mobile Deposit only at Stockman Bank" followed by your signature.

- Select Check Deposit in the app.

- Using the drop-down arrow, choose the account where your funds will be deposited.

- Enter the amount of the check.

- Following the prompts, take a photo of the front of the check and the back of the check.

- Make sure the picture has adequate lighting and the picture is clear. Blurry images can result in an image that cannot be processed.

- Once both sides are captured correctly, click Confirm.

- If your deposit attempt is successful, you will receive an email confirmation that the item has been received for review.

- Once your check has been reviewed, you will receive a second confirmation email stating the mobile deposit has been accepted or rejected.

- Submitted mobile deposit statuses can be viewed by selecting “Check Deposit,” then selecting the “History” tab in the upper right corner.

Important Tips for Making a Mobile Check Deposit:

- Make sure the background has a strong contrast to the check.

- Make sure the entire check is in the photo – both front and back.

- Make sure the photo is well lit and in focus.

- Be certain to have the proper endorsement.

*Mobile check deposits are not open to everyone. You may need to meet certain criteria to participate. Please check with your banker for more information.

*Not all checks are accepted through mobile deposit. Please see our terms and conditions for a complete list of prohibited items.

Your current limit can be located by tapping in the Amount field on the Check Deposit screen within the mobile app. We have established limits on the dollar amount and/or number of checks that you can deposit through the service.

If you attempt to use the service to initiate a deposit more than these limits, we may reject your deposit. Limits vary based on several risk factors such as, non-sufficient funds (NSF), and average monthly deposit balance.

We reserve the right to modify limits from time to time.

We recommend you retain the check for 60 days or until the check clears. The check should be destroyed after 60 days.

Bill Pay is a convenient way to pay your bills online.

- Make payments to individuals or companies (e.g. utilities, credit cards, loan payments, friends, relatives, etc.).

- Set up recurring or one-time payments.

- Set up reminders for due dates and receive notifications when your payments have been sent.

In order to take advantage of Bill Pay, you must be enrolled in Online Banking. To use Bill Pay:

- Log in to Online Banking.

- Go to Pay Bills in the navigation bar.

- Follow the prompts to sign up.

Learn more about Zelle®

No, Stockman Bank does not currently offer Zelle® for business customers. Currently, Zelle® is only available to our Personal Online Banking customers with personal accounts.